Live Meet & Greet With

sTANSBERRY ASSET MANAGEMENT

Coming to Fort Lauderdale!

1555 SE 17th St, Fort Lauderdale, FL 33316

December 10th - 11:30AM

Live Meet & Greet With

Coming to Fort Lauderdale!

1555 SE 17th St, Fort Lauderdale, FL 33316

December 10th - 11:30AM

WHAT WE DO

SAM is an SEC Registered Investment Adviser. As such we must act as a fiduciary, which means we must always put the client’s needs before ours. We take pride in our independent thinking. We avoid one-size-fits-all packaged products, creating tailored portfolios that cater to your individual goals—and add value over time.

SAM believes in multi-asset class investing, and invests not only in stocks and bonds, but also in less traditional asset classes such as commodities or real estate. Whether you're seeking an investment manager who shares your philosophy, you don't have the time to manage your investments, or you want to work with an advisor who understands the need to achieve higher risk-adjusted returns, we have the right solutions for you.

portfolio strategies

for every investor

Join us to learn more about each of SAM's investment strategies...

All Weather

The All-Weather strategy offered by Stansberry Asset Management, LLC (“SAM”) seeks to produce superior risk-adjusted returns through the full investment cycle with an emphasis on capital preservation. This strategy is designed to have less volatility than the stock market.

Total Alpha

The Total Alpha strategy offered by Stansberry Asset Management, LLC (“SAM) has a balanced approach that seeks to achieve growth, capital preservation, and income generation. This strategy will aim to capture the upside of bull markets, while implementing tight risk management during downturns.

Tactical Select

The Tactical Select strategy offered by Stansberry Asset Management, LLC (“SAM”) combines qualitative judgment with quantitative risk management to achieve growth, capital preservation, and income generation.

Income

The Income strategy offered by Stansberry Asset Management, LLC (“SAM”) prioritizes generating reliable income while also providing growth in up markets and protection in the event of a significant market downturn. This strategy typically yields significantly more than the overall stock market.

Venture Growth

The Venture Growth strategy offered by Stansberry Asset Management, LLC (“SAM”) is focused on generating long-term capital appreciation. This strategy does not have market capitalization constraints but often targets smaller companies that are earlier in their lifecycle and which we believe have long runways for growth ahead of them.

Forever

The Forever strategy offered by Stansberry Asset Management, LLC (“SAM”) seeks to own high-quality businesses over long periods. It also stays true to its name by investing in companies that we believe can be held essentially forever.

Treasury

The Treasury strategy offered by Stansberry Asset Management, LLC (“SAM”) generates current income in a very safe manner. This strategy will primarily invest in a ladder of short-term fixed-income Treasury securities that mature in less than two years. Bond laddering involves purchasing bonds with varying maturity dates.

Cornerstone

The Cornerstone strategy offered by Stansberry Asset Management, LLC (“SAM”) is designed to be an optimal strategy for accounts with a starting balance less than or equal to $100,000. This strategy features thematic elements from our All-Weather and Forever strategies.

YOUR PRESENTER

Austin Root, CIO

Chief Investment Officer

Join Stansberry Asset Management LIVE for a presentation on September 19th. Austin Root, our Chief Investment Officer, will delve into how SAM seamlessly integrates informed, active, and sophisticated management with comprehensive financial planning.

Learn about how our tailored portfolios are designed to assist you in achieving your financial goals.

Austin Root is the Chief Investment Officer of Stansberry Asset Management (or SAM) and is responsible for the development and management of investment strategies across all SAM portfolios. Prior to joining SAM, Austin was the Director of Research at Stansberry Research and the portfolio manager for the company’s flagship portfolio products, Stansberry Portfolio Solutions.

Event Details: December 10th - 11:30AM

Location:

1555 SE 17th St, Fort Lauderdale, FL 33316

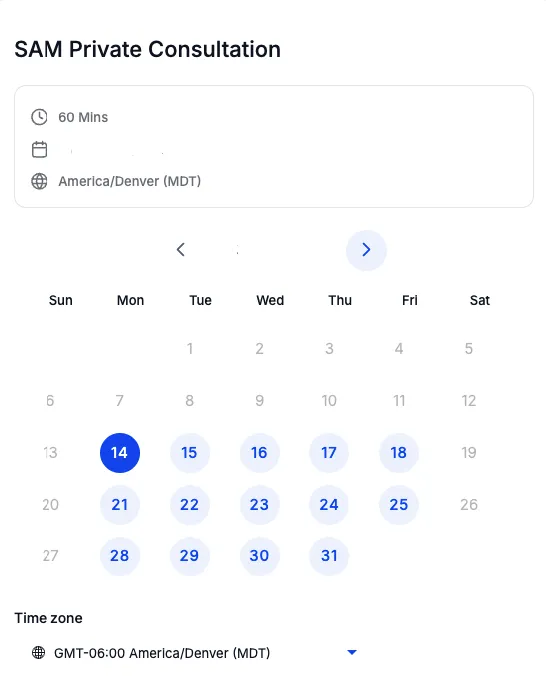

SCHEDULE YOUR PRIVATE CONSULTATION

Imagine having a crystal-clear vision for your financial future.

That’s exactly what a one-on-one meeting with our investment specialists can offer you.

Sit down with us, and let’s explore your specific investment goals and objectives together.

Our specialists are not just advisors; they’re architects of investment strategies tailored to your specific goals and objectives.

Whether you're aiming for retirement, funding college for your kids or grandkids, or building generational wealth, we help you find the right investment strategy for you.

To schedule your private consult, simply click on the calendar to the left and choose the date and time that work best for you.

We look forward to visiting with you!

SCHEDULE YOUR PRIVATE CONSULTATION

Imagine having a crystal-clear vision for your financial future.

That’s exactly what a one-on-one meeting with our investment specialists can offer you.

Sit down with us, and let’s explore your specific investment goals and objectives together.

Our specialists are not just advisors; they’re architects of investment strategies tailored to your specific goals and objectives.

Whether you're aiming for retirement, funding college for your kids or grandkids, or building generational wealth, we help you find the right investment strategy for you.

To schedule your private consult, simply click on the calendar to the left and choose the date and time that work best for you.

We look forward to visiting with you!

OFFICE LOCATIONS:

Westlake, TX

1600 Solana Blvd. Suite 8100 Westlake, TX 76262

New York, NY

420 Lexington Avenue

Suite 2216

New York, NY 10170

Clifton Park, NY

19 Clifton Country Rd. Suite 2

Clifton Park, NY 12065

San Francisco

2 Embarcadero Center, Suite 08-104, San Francisco, CA 94111

Stansberry Asset Management (“SAM”) is a Registered Investment Advisor with the United States Securities and Exchange Commission. File number: 801-107061. Such registration does not imply any level of skill or training. For more information on SAM, please visit IAPD – Investment Adviser Public Disclosure – Homepage (sec.gov)

© 2024 Stansberry Asset Management. All rights reserved.